Understanding Mining Pools and Their Importance

A mining pool is a group of miners who combine their computing resources to maximize the chances of successfully mining a block. Miners in a pool share resources and rewards rather than compete with the entire network. When the pool discovers a block, the reward is allocated to participants depending on their participation, which is often measured by hashrate.

Mining pools can be categorized by their reward distribution models, which is the most common way to differentiate them. Common reward models in mining pools include Pay-Per-Share (PPS), Pay-Per-Share Plus (PPS+), Full-Pay-Per-Share (FPPS), Pay-Per-Last-N-Shares. These reward models make up the different types of mining pools.

Types of Mining Pools Explained: PPS, PPS+, FPPS, and PPLNS

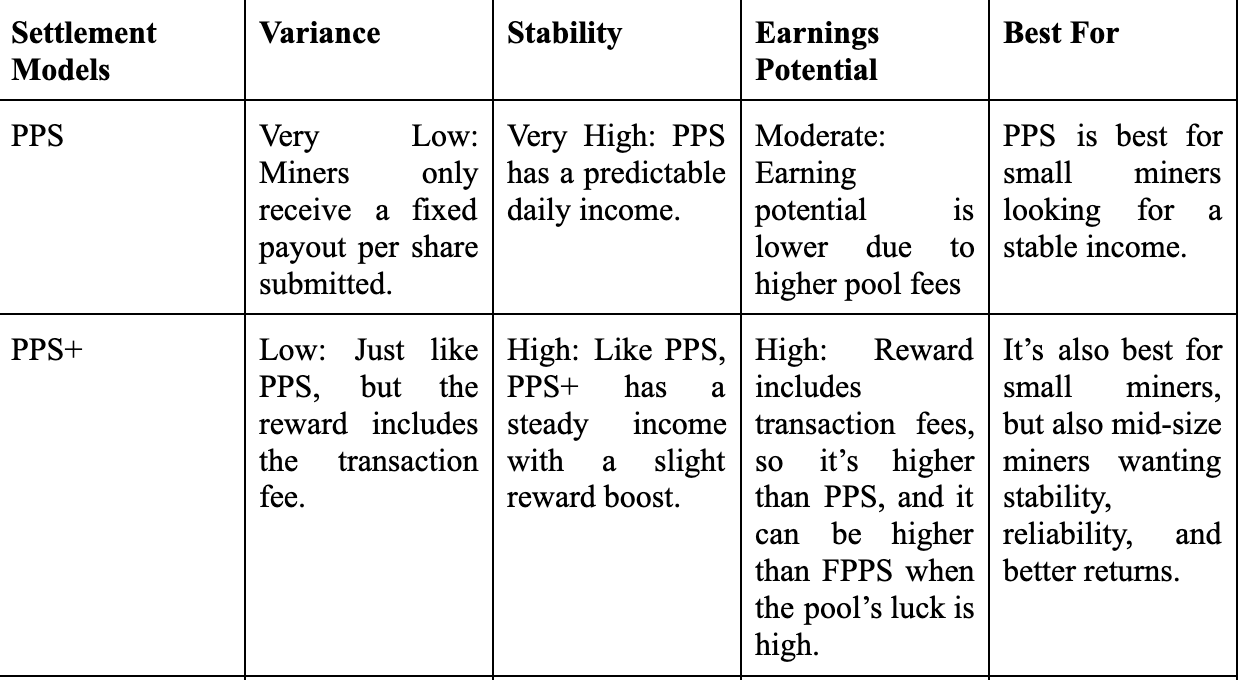

1.PPS (Pay-Per-Share)

Pay-Per-Share (PPS) is a mining pool payment mechanism that pays miners a set sum for each valid share they submit, regardless of whether the pool successfully finds a block. This method eliminates the "luck factor" of block discovery, resulting in a constant and predictable revenue. It is ideal for miners who require continuous cash flow.

2.PPS+ (Pay-Per-Share Plus)

Pay Per Share Plus (PPS+) is a mining pool payout mechanism that combines the traditional Pay Per Share (PPS) model's consistent, predictable income with a portion of transaction fees dispersed using the Pay Per Last N Shares (PPLNS) approach. This ensures miners receive a consistent payout for each valid share they submit, as well as additional earnings from transaction fees when the pool discovers a block.

3.FPPS (Full-Pay-Per-Share)

FPPS, or Full Pay-Per-Share, is a cryptocurrency mining pool compensation model in which miners receive a predictable, fixed payment for each valid share submitted. It is a more advanced form of the Pay-Per-Share (PPS) model that includes a portion of both the block reward and transaction fees, with the pool operator bearing the risk of finding blocks. This strategy provides a consistent revenue and is popular among miners who wish to eliminate the risk of not discovering blocks.

4.PPLNS (Pay-Per-Last-N-Shares)

PPLNS, or Pay-Per-Last-N-Shares, is a mining pool payout system in which miners are compensated depending on the number of shares they contributed to the pool's most recent "N" shares submitted right before a block was successfully mined. This approach calculates payouts once the pool discovers a block by dividing the block's rewards (including transaction fees) proportionally among miners depending on their share of the labor.

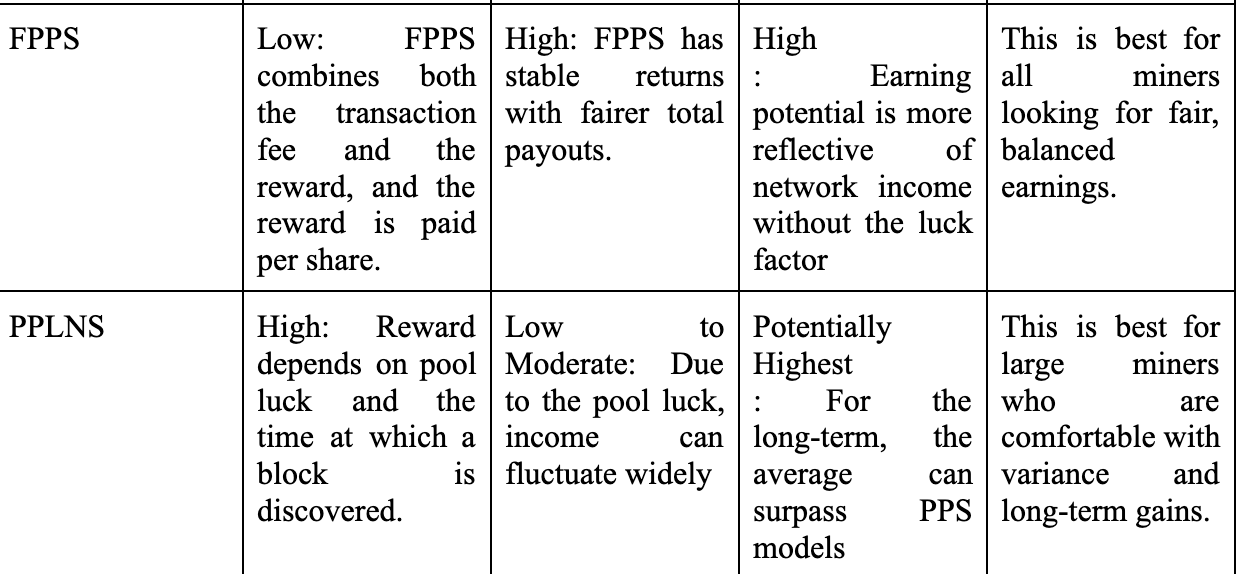

Comparing Settlement Models: Variance, Stability, and Earnings Potential

Fee Structures, Payout Frequency, and Capital Efficiency

The fee structure, minimum withdrawal, and payout frequency of a mining pool all have a substantial impact on a miner's capital efficiency, as they affect profitability, cash flow, and financial flexibility. Capital efficiency is the ability to maximize output and returns on invested capital.

The fee structure directly reduces a miner's total revenue. A higher fee results in a lesser portion of the rewards, which immediately reduces profitability per unit of hashrate. The minimum withdrawal threshold influences a miner's cash flow and access to money for reinvestment.

Payout frequency determines how often a miner receives earnings, which is important for managing cash flow.

Conclusion

The best ideal mining pool model is mostly determined by your hashrate capabilities and risk tolerance. Small-scale miners seek constant payouts to reduce revenue volatility, whereas large-scale miners with more processing power can tolerate more variability in exchange for possibly higher rewards.

Disclaimer

The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed, or investment, or trading advice. Qualified professionals should be consulted before making financial decisions.