On February 29, the price of Bitcoin briefly touched $64,000, marking the first time in 28 months since November 2021 that Bitcoin surpassed the $60,000 mark. Over the past week, its price has increased by more than 20%, with a total market value exceeding $1.3 trillion, surpassing Meta in the global asset value rankings and moving up one place.

Bitcoin, as the pioneer of PoW mining projects, has not only excelled recently but also positively influenced other PoW coins. Data from CryptoSlate shows that PoW coins maintain a commanding 55.36% share of the total crypto market. Beyond Bitcoin, miners have shown keen interest in coins such as Litecoin (LTC), Dogecoin (DOGE), and Kaspa (KAS), which have all seen impressive performances in February. This analysis will delve into the true state of these PoW coins using on-chain data.

Network Hashrate

Hashrate is a unit of measurement for the number of hash operations that can be performed per second, and it is also a key indicator for measuring network security and determining the mining difficulty for miners to earn block rewards. The higher the hashrate, the more computational resources are devoted to verifying and recording transactions, making the network harder to be compromised by a 51% attack (an attack requiring the attacker to control more than half of the network's hashrate to rewrite the blockchain's history), thus making the network more secure.

Furthermore, a high network hashrate is commonly interpreted as a demonstration of faith in the PoW project's future, indicative of miners' belief in its enduring value.

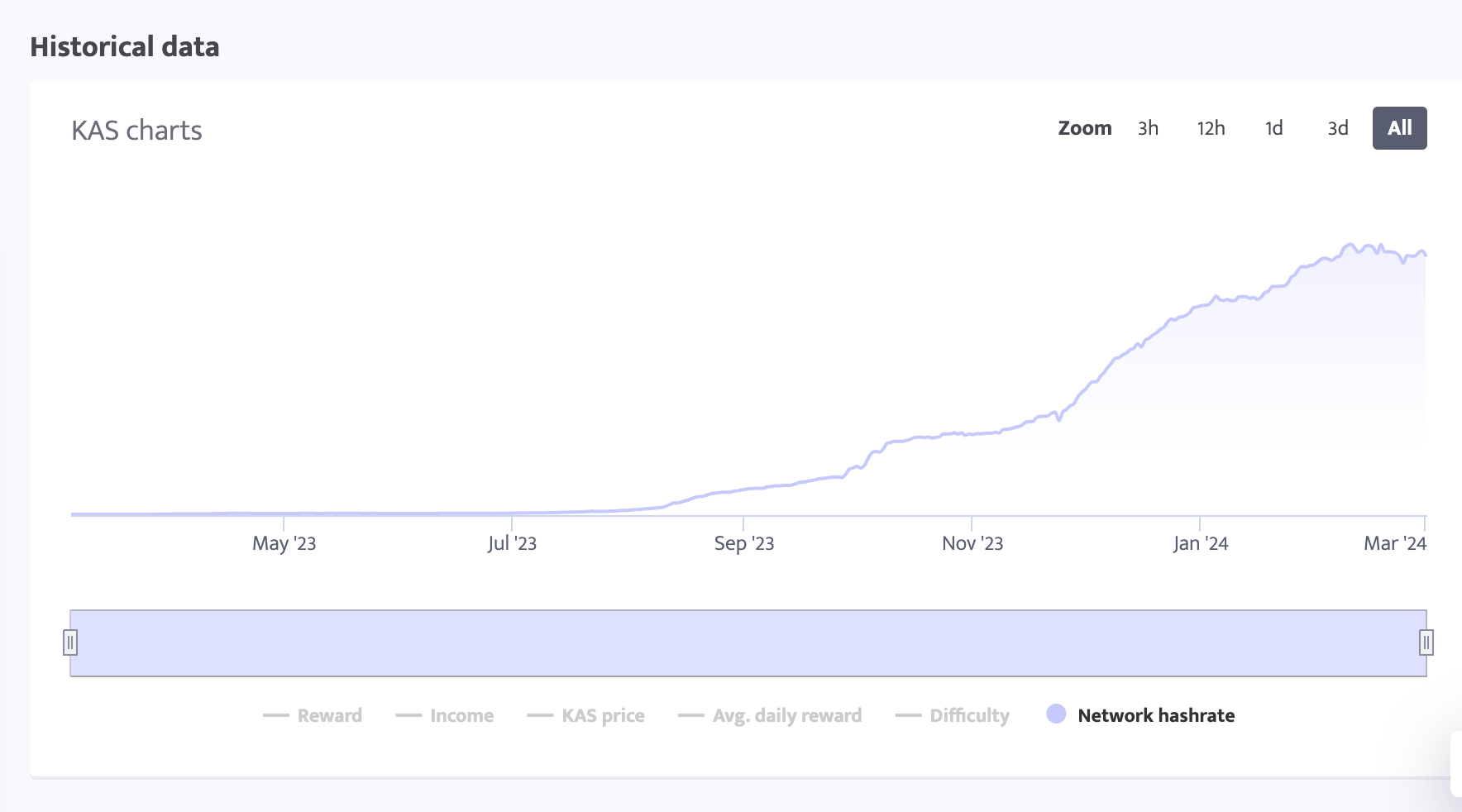

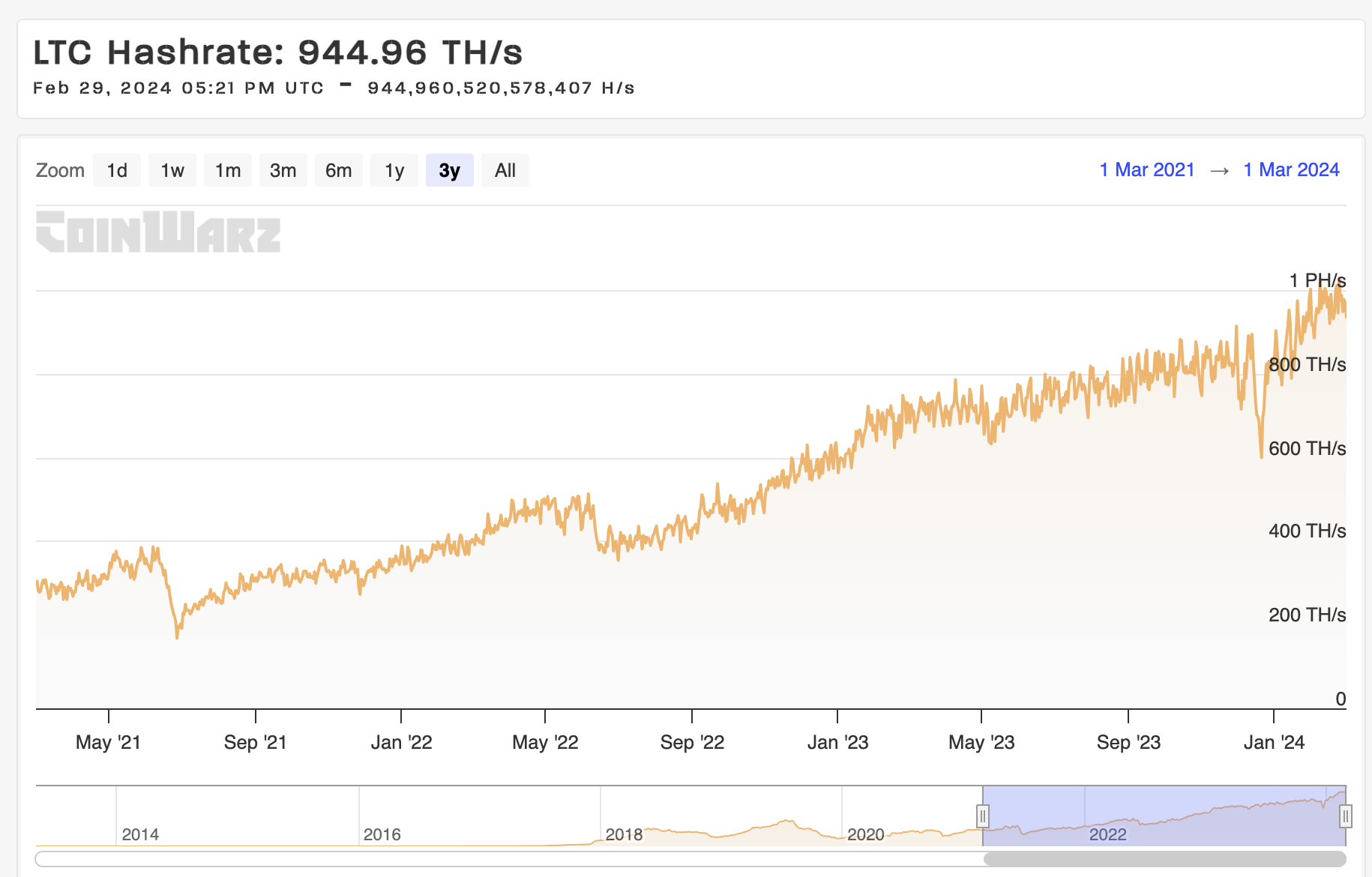

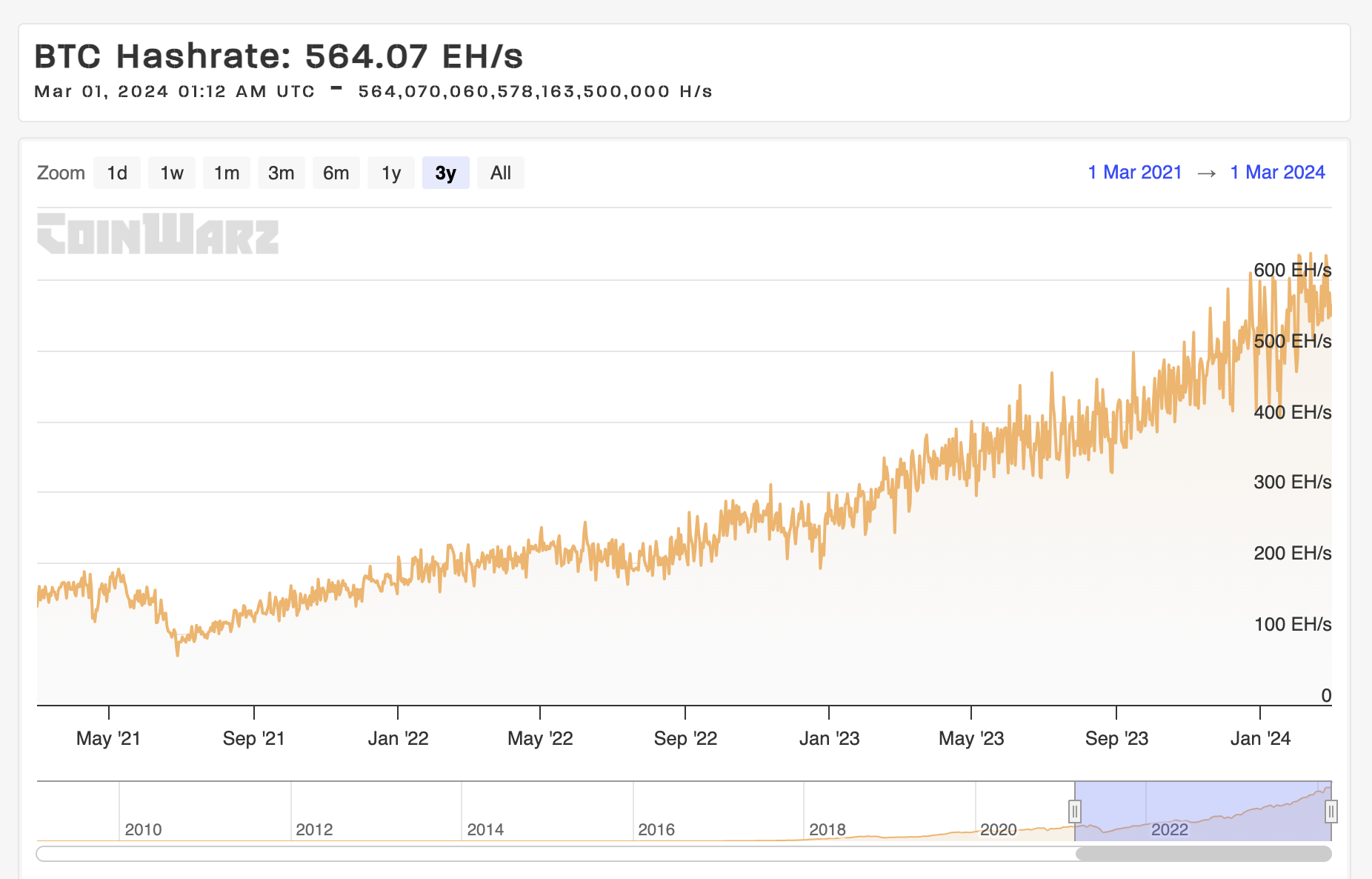

According to blockchain explorers, Bitcoin, Litecoin, and Kaspa network hashrate all reached unprecedented peaks in February:

- First, the Kaspa's network hashrate hit a historical peak of 186.57 PH/s on February 14th.

- Next, Litecoin's network hashrate set a new historical record on February 21st, with a hashrate of 1.45 PH/s at block 2,637,200.

- Finally, Bitcoin's network hashrate reached an all-time high on February 25th, with a hashrate of 740.69 EH/s at block 832,057.

Kaspa historical hashrate trend, from Minerstat.

Litecoin's hashrate trend over the past 3 years, from CoinWarz.

Bitcoin's hashrate trend over the past 3 years, from CoinWarz.

Although the growth in hashrate and mining difficulty indeed enhances the network's security and resistance to attacks, it may also lead to reduced mining profits for miners. Taking Bitcoin as an example, with the increase in hashrate, its mining difficulty also rises (due to Bitcoin's difficulty auto-adjustment mechanism aimed at maintaining an average block generation time of every 10 minutes). Such changes pose greater challenges for individual miners and small mining pools in competing for block validation rights. At the same time, compared to the new generation of mining rigs, older mining rigs become less competitive in terms of energy efficiency and profitability, facing the fate of being phased out.

Trading Volume

Trading volume is an important indicator of a project's level of activity. Blockchain explorers show that the trading volumes of the Bitcoin, Litecoin, and Kaspa networks in February are as follows:

- In February, there were approximately 10.18 million transactions on the Bitcoin network, with a total transaction value of about $1.23 trillion. Compared to January, the transaction volume decreased by 31.2%, but the total transaction value increased by 1.7%.

- In February, there were approximately 6.79 million transactions on the Litecoin network. Compared to January, the transaction volume decreased by 60%.

- In February, there were approximately 3.5 million transactions on the Kaspa network. Compared to January, the transaction volume decreased by 5.6%.

Despite February being two days shorter than January this year, data from various aspects including transaction volume and search interest indicate that retail investor participation in this round of price increase was relatively low. Taking Bitcoin as an example, its on-chain transaction volume showed a growth trend, but there was still a significant gap compared to the market peak in 2021. Analysts point out that the approval of Spot Bitcoin ETFs provided institutional investors with a convenient channel to participate in Bitcoin investments, and the inflow of funds from institutional investors from the traditional financial market became one of the key drivers for the price increase in the crypto market this round.

Hash Price

Hash price refers to the market value of each unit of hashing power. Typically measured in USD/unit of hashing power, hash price is a key metric for miners, as it allows them to assess the profitability of their current mining operations.

Blockchain explorers show that the hash price indicators for Bitcoin, Litecoin, and Kaspa in February are as follows:

- In the last month, due to the rise in BTC price, the hash price has warmed up. Per PH/s earnings increased from $81.27 at the beginning of the month to the current $104.61, an increase of 28.7%.

- Similarly, due to the rise in LTC price, its per hashrate earnings have also improved. Excluding the extra DOGE rewards, per GH/s earnings rose from $0.25 at the beginning of the month to the current $0.31, marking a 24% increase.

- Kaspa's token KAS hit a new all-time high in February, accordingly, per hashrate earnings have improved. Per TH/s earnings went from $7.12 at the start of the month to the current $11.91, achieving a 67.3% increase.

With the increase in per hashrate earnings for leading PoW coins in February, it is expected to attract more miners and even some institutions to participate in mining. Especially as the next Bitcoin halving event is set to occur in less than two months, participants related to Bitcoin have already begun to take action. This could lead to significant volatility in the crypto market, so please be mindful of risk management.

To sum up, the performance of leading PoW coins in February is viewed by many investors as a positive sign ahead of the Bitcoin halving event, and it has heightened anticipation for this crypto bull market. The successful link of traditional finance and the crypto world through Spot Bitcoin ETFs begs the question: what is the limit for the total market value of crypto in this bull market? We wait with bated breath!

*The BTC, LTC, DOGE, and KAS mentioned above can all be mined through the ViaBTC.

About ViaBTC

ViaBTC, founded in May 2016, has provided professional, efficient, safe and stable crypto mining services for over one million users in 130+ countries/regions around the world, with a cumulative mining output value of tens of billions of dollars. This world-leading, all-inclusive mining pool offers mining services spanning more than ten mainstream cryptos that include BTC, LTC, and KAS. Backed by one-stop services covering ViaBTC Pool, CoinEx Exchange, and CoinEx Wallet, ViaBTC strives to offer global users more supporting tools, stabler and more efficient mining services, as well as better product experience.