Bitcoin halving is a highly anticipated event in the crypto industry. Financial markets, including the crypto market, often demonstrate cyclical patterns, and Bitcoin halving, which happens approximately every four years, is a key factor in this cyclicality. Investors tend to have high expectations for halving dates.

This article will review data from previous halving cycles to help investors gain a deeper understanding of the impact that halving has on the market.

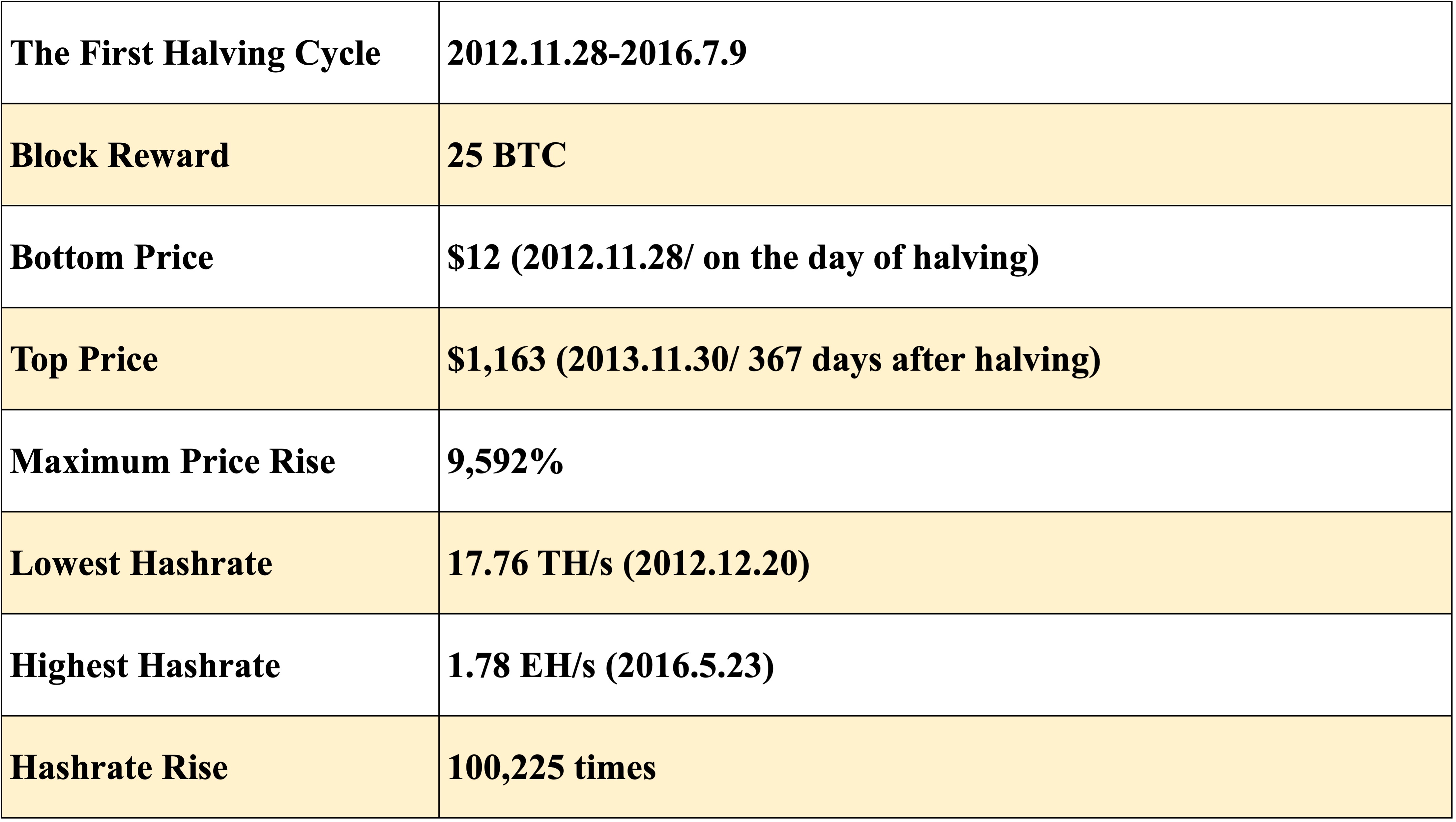

The First Halving

The first Bitcoin halving occurred on November 28, 2012. Prior to this halving event, Bitcoin was not quite popular. Historically, Bitcoin was mined on CPU, GPU, and then FPGA, and the crypto community mainly focused on technical discussions.

In the first halving cycle, more users began to focus on Bitcoin, and the application-specific integrated circuit (ASIC) miner became prevalent. Between 2012 and 2016, ASIC chips advanced through three iterations at 110nm, 55nm, and 28nm, resulting in a 100,000-fold increase in hashrate. These four years marked rapid progress in mining rigs, with the network hashrate experiencing its fastest growth.

Network Hashrate During the First Halving Cycle

Source: BTC. com

Following the halving, Bitcoin's price skyrocketed, increasing by 95-fold within a year to surpass $1,000. The remarkable surge piqued the interest of many new investors in this emerging currency system.

BTC Price During the First Halving Cycle

Source: TradingView

The Second Halving

The second Bitcoin halving happened on July 9, 2016. After that, ASIC miners with 28nm and 16nm chips were introduced, leading to a more than hundredfold increase in the network hashrate.

Furthermore, this cycle represented four years of increasing appeal for Bitcoin among everyday investors. In 2017, the establishment of numerous crypto venture capital firms and hedge funds fueled rapid growth in Bitcoin's market cap and the entire industry. Over the year and a half following the halving, Bitcoin's price surged by 41-fold. On Thanksgiving Day in 2017, Bitcoin became a hot topic, sparking a surge in Google searches about how to invest in Bitcoin. Major financial media outlets hurried to report on this innovative investment object.

BTC Price During the Second Halving Cycle

Source: TradingView

The Third Halving

The third Bitcoin halving took place on May 11, 2020. During this cycle, relevant policies dealt the heaviest blow to mining. For example, in June 2021, China implemented policies to ban crypto mining, leading to a sharp decline in the network hashrate, which hit a record low. Fortunately, with the introduction of the 7nm ASIC miner and the entry of numerous professional mining companies into the industry, the network hashrate swiftly rebounded to its pre-policy level and has since continued to grow steadily.

During this cycle, traditional financial institutions and publicly traded companies, such as Grayscale, Ark, MicroStrategy, and Tesla, began purchasing Bitcoin. Well-known enterprises including Paypal, Twitter (now known as X), and Facebook (now known as Meta) also showed support. The conversations about Bitcoin and cryptocurrencies have become common, whether on Wall Street or in big Internet companies. It's evident that Bitcoin has evolved from being seen as a "scam" to a legitimate investment option.

BTC Price During the Third Halving Cycle

Source: TradingView

The Upcoming Halving: A Crisis or an Opportunity?

Based on the current trend, the fourth Bitcoin halving is anticipated to happen in April 2024. The halving of rewards will reduce BTC revenue, raising concerns about a sudden decline in miners' earnings. With the rising hashrate, the cost of mining Bitcoin is expected to go up. As a result, some anticipate that the next halving could lead to the shutdown of many mining rigs, posing a challenging situation for miners.

The prevailing opinion is that the time around the last three halving events saw the lowest prices in the cycle, with prices reaching new highs within one to one and a half years. In the next cycle, the approval of the Bitcoin spot ETF is expected to dominate industry headlines. Once the Bitcoin spot ETF gets the green light, it could lead to new advancements for Bitcoin, drawing in a wider and larger audience from traditional financial markets. If Bitcoin's price continues to rise as in past cycles, it could create a new opportunity for miners.

About ViaBTC

ViaBTC, founded in May 2016, has provided professional, efficient, safe, and stable crypto mining services for over one million users in 130+ countries/regions around the world, with a cumulative mining output value of tens of billions of dollars. This world-leading, all-inclusive mining pool offers mining services spanning more than ten mainstream cryptos that include BTC, LTC, and KAS. Backed by one-stop ecosystem services encompassing ViaBTC Pool, ViaWallet, and CoinEx Smart Chain (CSC), ViaBTC strives to offer global users more diverse supporting tools, stabler and more efficient mining services, and better product experiences.