As December reaches its midpoint, the stage is quietly set for 2024. The recent uptick in the crypto market seems to suggest the end of the long crypto winter, renewing optimism in the market. Investors and industry analysts widely anticipate that the coming year will be a pivotal turning point for the crypto industry. Looking ahead to next year, the fourth Bitcoin halving, in addition to the likely approval of the Bitcoin spot ETF, will be a major highlight.

Based on relevant data, the fourth Bitcoin halving is projected to occur around April 23, 2024. This event holds significant importance for Bitcoin and the entire crypto market, influencing various stakeholders such as mining rig manufacturers, crypto mining enterprises, mining pools, miners, and numerous Bitcoin investors.

A Brief Review of Bitcoin Halving

Bitcoin halving involves halving the block reward in the Bitcoin network every 210,000 new blocks, which occurs roughly every 4 years, a rule pre-programmed into Bitcoin's underlying code. Since its inception in 2008, Bitcoin has experienced three halving events in 2012, 2016, and 2020 respectively.

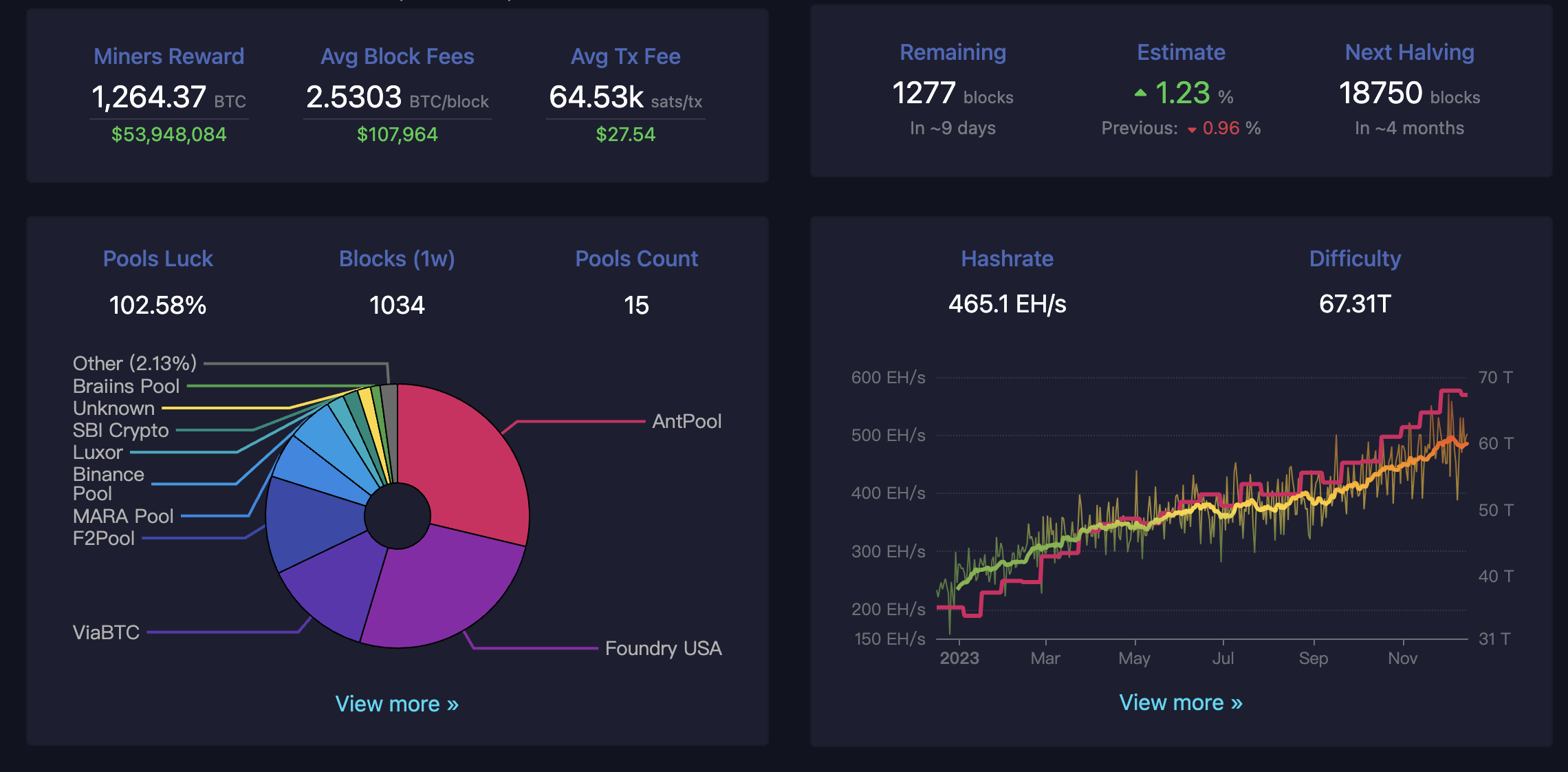

As of this writing, there are 18,750 blocks away from the next Bitcoin halving

A Brief Discussion on Bitcoin Halving

Halving aims to control Bitcoin's inflation by reducing the number of new bitcoins generated, effectively slowing down the total supply of Bitcoin to the limit of 21 million coins. This scarcity ultimately enhances Bitcoin's value in the long run.

However, in the short term, Bitcoin halving will deal a heavy blow to the entire crypto mining industry.

Halving reduces miners' income, as block rewards make up over 90% of their revenue. After halving, the number of bitcoins mined per day decreases by 50%, leading to increased costs. Consequently, miners with high operating costs may exit, affecting the distribution of hashrate in the Bitcoin network. It is anticipated that the network hashrate will become more centralized after the fourth Bitcoin halving.

As mining rewards decrease, there's a growing demand for more efficient mining rigs to sustain profitability, prompting mining rig manufacturers to invest in technological research and development. Leading manufacturers like BITMAIN, MicroBT, and Canaan have recently introduced multiple ASIC models with energy efficiency of less than 20 J/T, setting the stage for the halving.

In a volatile market, crypto mining companies must optimize operations and bolster risk resilience, which rings especially true in the case of Core Scientific.

Mining pools should offer additional tools to help miners improve capital utilization to mitigate losses during short-term Bitcoin price fluctuations, while still providing an efficient and stable mining network. A good example in point is ViaBTC’s Crypto Loans and Hedging Service.

ViaBTC, a global cryptocurrency mining pool, stands out as one of the few pools that distribute mining rewards on an hourly basis, significantly boosting miners' earnings efficiency. Additionally, by integrating traditional financial principles, ViaBTC offers two financial products, namely "Crypto Loans" and "Hedging Service". These products enable miners to maximize fund utilization across various market conditions, ultimately maximizing their returns.

*For details, refer to:

Crypto Loans: https://www.viabtc.com/s/DF9R

Hedging Service: https://www.viabtc.com/s/AwVi

Conclusion

While historical data typically suggests a price increase in Bitcoin after halving, the evolving market dynamics may witness different stories this time. Thus, miners and investors should stay composed and make informed investment choices.

Overall, despite the considerable uncertainty surrounding the 2024 Bitcoin halving, it will undoubtedly represent another significant milestone in crypto history.