As 2023 draws to a close, crypto investors are

filled with anticipation for the next Bitcoin halving scheduled for 2024.

Occurring once every four years, the BTC halving fortifies Bitcoin’s status as

digital gold. The No.1 crypto's ability to maintain steady growth in its value

is widely acknowledged to be closely linked to its scarcity.

Bitcoin Halving

Satoshi Nakamoto programmed the halving mechanism to preserve Bitcoin’s scarcity. Specifically, the block reward for BTC mining is halved every 210,000 blocks, allowing the network to maintain the ultimate total BTC supply at 21 million coins. So far, Bitcoin has seen three halvings, which have brought down the block reward from 50 BTC in 2009 to the current 6.25 BTC. After the 2024 halving, the figure will further decrease to 3.125 BTC.

Market Impact of Bitcoin Halving

The BTC price is most affected by Bitcoin halvings. From the perspective of tokenomics, a BTC halving gradually slows down the speed of BTC supply. At the same time, as Bitcoin changes investor perceptions, more individuals have recognized the coin and included it in their portfolios, driving up demand for Bitcoin. Besides, as decentralized wallets must be managed by users themselves, some early users permanently lost their holdings due to poorly managed private keys, which further reduced Bitcoin’s circulating supply.

The combination of factors including slowed supply, growing demand, constant total supply, and the permanent loss of some coins, amplified by supply-demand dynamics and market sentiment, had resulted in more than a double-fold price surge during many previous halving events.

That said, it is not appropriate to focus our discussion solely on prices. For investors, the financial impact of halving involves passive price fluctuations, without direct losses even if prices do not rise. For miners, however, the impact is more complex.

Bitcoin Halving’s Impact on Miners

The most direct impact of halving on miners is a halving of the block reward, which means that their daily income is cut by half, assuming constant network hashrate, costs, and prices.

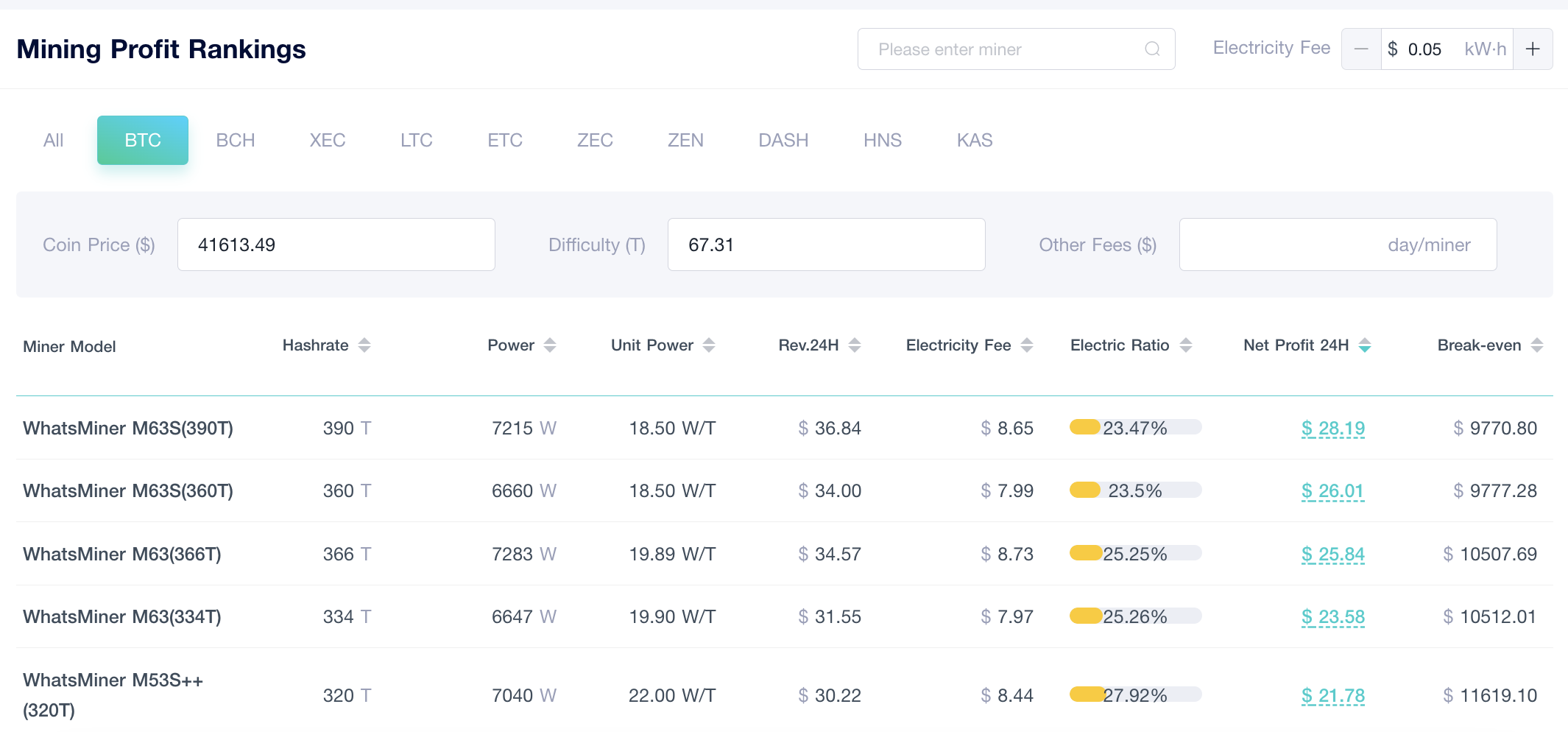

According to ViaBTC’s Mining Profit Rankings, the 24H revenue of WhatsMiner M63S (390T) stands at $36.84. Assuming the electricity price to be $0.05 per kWh, a WhatsMiner M63S (390T) costs $8.65 in power expense and yields a daily profit of $28.19. If the block reward is halved, the 24H revenue will drop to $18.42, bringing down the daily profit to $9.77, a 65% reduction. Models burning an electricity fee exceeding 50% of the revenue, such as WhatsMiner M20S+, might be shut down.

Following the halving, miners will clearly become more cost-sensitive. That said, our calculations assume fixed factors such as network hashrate and price, which will not be the case in reality. If the BTC price doubled after the next halving (as seen in previous halvings), miners could maintain or even improve their current profit margins.

Furthermore, the BTC hashrate might go down, as some miners may shut down their operations due to high costs. For instance, following the third halving in May 2020, the BTC hashrate started dropping from around 130 EH/s and bottomed out at 81.66 EH/s. Such a development would offer persistent miners a higher market share and increased earnings.

In a nutshell, miners with low electricity costs will have an easier time during the next halving, while those with higher costs and low liquidity may struggle. Despite that, many miners have withstood the challenges of the quadrennial event in the past three halvings. Will history repeat itself in the next BTC halving? Let’s wait for 2024 to find out.